Investing during a down market How to dollar-cost average

Content

Consider the assets you’ve set aside for medium-term needs or goals. Being diversified means you have a wide variety of investment-grade bonds—corporate, municipals, Treasuries, and possibly foreign issues. And they should have varying maturity dates, from short-term to mid-term, so you always have some bonds maturing and providing you with either income or money to reinvest. Among equities, defensive stock market sectors including consumer staples, utilities, and health care have outperformed during bear markets. The goods and services these sectors supply tend to be in demand regardless of economic or market conditions.

A bear market is a good time to assess whether your portfolio’s asset allocation really suits your risk tolerance. It’s simply a matter of which assets carry the greatest risk right now. While bonds are less volatile than stocks, they can also experience prolonged drawdowns and losses. It’s entirely possible, albeit rare, for stock and bond bear markets to occur simultaneously. Unlike stock market corrections (in which there’s only a 10% drop) bear markets generally last longer and have a more substantial impact on the economy. Investors should use sell-offs as opportunities to harvest capital losses—a strategy that over time we estimate can add about 0.5% to after-tax annual portfolio returns.

Remember, There Are No Risk-Free Investments

Overall, value stocks outperformed growth stocks with returns of 17% versus 12.6%. However, in downturned economies, growth stocks proved to be the better performer. Most of my columns are aimed at people who already have some involvement with stock and bond investing, often using mutual funds or exchange-traded funds. It’s written mainly for people who are still in school, or just starting in the work force, or just getting around to salting away money for the future.

Past performance is no guarantee of future results and the opinions presented cannot be viewed as an indicator of future performance. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources.

What Is Tactical Asset Allocation?

A market drop isn’t guaranteed if the Fiscal Responsibility Act is put into action but investors fear that borrowing may become more expensive as government spending levels fall. But some investors are predicting cloudy skies ahead with the struggling labor market and higher interest rates in real estate. Plus, the recent bank failures could foreshadow impending troubles for small businesses seeking out credit. The longest bull market in history was over 131.4 months following the Great Recession. From March 2009 to March 2020, the S&P 500 increased by 400% and gained over $18 trillion in value.

This report does not constitute an offer to sell or the solicitation of an offer to buy any securities in the PRC. There is no exact science for distinguishing or recognizing a bear market, but market watchers generally refer to a decline of 20 percent or more as a bear market. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Plan strategically

“Bull markets are typically accompanied by a low number of individuals needing employment and investors who are flush with cash to buy into the markets.” We define a bear market as an episode where US large-cap stocks fall by at least 20% from peak to trough. Rather than focus only on the peak-to-trough drop time period—what we call the “drawdown” period—we also include the time that it takes for stocks to register another all-time high—what we call the “recovery” period.

After share prices start dropping hard, making big switches could backfire. Conservative portfolio shifts work best when in anticipation and not after a brutal sell-off, which is when equities may be undervalued. As a result, investors likely have more time than they think to respond to the stock market’s sagging fortunes, whether by adopting prudently defensive portfolio positioning or by speculating on continued declines. Corrections can become bear markets, but more often they don’t. Between 1974 and 2018, there were 22 market corrections, and only four turned into bear markets. There’s no doubt that bear markets can be scary, but the stock market has proven it will bounce back eventually.

- “No one knows where the bottom is, but we do know stocks are on sale right now.”

- Conservative portfolio shifts work best when in anticipation and not after a brutal sell-off, which is when equities may be undervalued.

- The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice.

- They simply tend to be less frequent and more short-lived than their bull market counterparts.

Prices are much better for buyers than they were at the beginning of the year because we are in a bear market, which means simply that the stock market over all has fallen at least 20 percent from its peak. While the past doesn’t guarantee anything about the future, the fact is that the American stock market has always recovered from declines over stretches of at least 20 years. If you can plan on buying and holding stocks for 20 years or more, by all means, buy now. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. (Member SIPC), offers investment services and products, including Schwab brokerage accounts.

Key characteristics of a bull market

John Waggoner covers all things financial for AARP, from budgeting and taxes to retirement planning and Social Security. Previously he was a reporter for Kiplinger’s Personal Finance and USA Today and has written books on investing and the 2008 financial crisis. Waggoner’s USA Today investing column ran in dozens of newspapers for 25 years.

Bear markets can be painful, but thankfully are usually short-lived. While it may seem like selling during a bear market would be easy to do, timing the market can be impossible, even for professionals. Short-term bonds in a bear market could help investors weather the (hopefully) short-term downturn. Higher-quality or investment-grade bonds would be a better choice here for investors whose goal is to hedge overall market risk during bear markets.

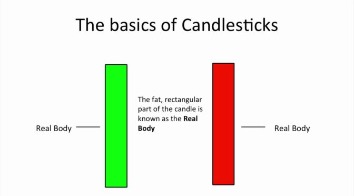

The good news is that the past data indicates the market has collectively had more good years than bad years. The length of the average bear market, when an index like the S&P 500 loses 20% or more of its value, is just under a year. Understanding how a bull market works including some realistic ways to invest during those seasons can help you grow your investments with confidence. Here’s how dollar-cost averaging might have paid off for someone who invested consistently through the 2007–2009 bear market, notable for being one of the most severe in a generation. Dollar-cost averaging is a strategy in which you invest your money in equal amounts, at regular intervals—say $250 a month—regardless of which direction the market or a particular investment is going.

Ensure that you have enough available cash to cushion at least six months of expenses, especially as economic conditions are unfavorable. And affiliated banks, Members FDIC and wholly owned subsidiaries of Bank of America Corporation. Insurance and annuity products are offered through Merrill Lynch Life Agency Inc., a licensed insurance agency and wholly owned subsidiary of Bank of America Corporation. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. For more information on indexes please see schwab.com/indexdefinitions. Investing in REITs may pose additional risks such as real estate industry risk, interest rate risk and liquidity risk.

How would protecting your spending needs change your portfolio under the worst historical circumstances?

When the market turns around again, you will come out on the other side with more value as prices rise in the bull market. Bear markets tend to present themselves when market prices have been rising for a time; investors are feeling irrationally exuberant. This feeling is like a gambler’s high during speculative bubbles. The most important thing an investor can do during a bear market (once they’ve assessed their holdings accordingly) is to wait it out.

Timing the market is extraordinarily difficult, and getting it wrong could cripple your returns. A $10,000 investment in a fund tracking the S&P 500 at the end of 2006 would have grown to nearly $46,000 by the end of 2021, according to Putnam Investments. The bottom of the market could be well into the future, and selling now before things get worse could, in the long run, boost your returns.

During bear markets, all the companies in a given stock index, such as the S&P 500, generally fall — but not necessarily by similar amounts. If you’re invested in a mix of relative winners and losers, it helps to minimize your portfolio’s overall losses. While 20% is the threshold, bear markets often plummet much deeper than that over a sustained period. Although a bear market may have a few occasional “relief rallies,” the general trend is downward. Bear markets are characterized by investors’ pessimism and low confidence.

You should consult with appropriate counsel, financial professionals or other advisors on all matters pertaining to legal, tax, or accounting obligations and requirements. Asset allocation and diversification do not ensure a profit or protect against a loss. Brokerage accounts can also be a helpful tool in reaching long-term goals. Depending how much money you make and if you’re not covered by a retirement plan at work, you may be able to deduct all or a portion of your traditional IRA contributions from your taxes (read details on the IRS website).

If you feel as though your emotions are getting the better of you, consider reaching out for professional advice. An advisor can help you review your financial approach and offer investment insights that may help limit the https://g-markets.net/helpful-articles/the-difference-between-hammer-inverted-hammer-doji/ effect that a market downturn could have on your short- and long-term goals. And as the markets recover, your advisor can continue to help you stay on track, working with you to adjust as your priorities change over time.

T-bills are represented by the total returns of the Ibbotson U.S. 30-day Treasury Bill Index. Since 1970, there have been a total of six periods where the market dropped by 20% or more. The cumulative return for each period and scenario is calculated as the simple average of the cumulative returns from each period and scenario. One important distinction is the difference between a bull market and a bear market rally.